Many universities generate significant revenue by opening campus accommodation to tourists during conferences and events, holidays, summer lets, and festival visitors, as well as for short-term lets. But from 24 July 2026, Edinburgh will require a 5% visitor levy on tourist accommodation for the first five consecutive nights, fundamentally changing how you manage these bookings.

If your organisation offers accommodation to tourists, here’s what you need to know.

Does the tourist tax levy apply to you?

The visitor levy affects institutions that provide accommodation to:

- Student lets – only when let to visitors and non-Edinburgh students

- Conference delegates and business visitors

- Festival attendees during the Edinburgh Festival, Fringe, and other events

- Tourists using campus hotels or short-term lets during holidays

- Event visitors for graduations, open days, and special occasions

The Implementation Timeline You Need to Know

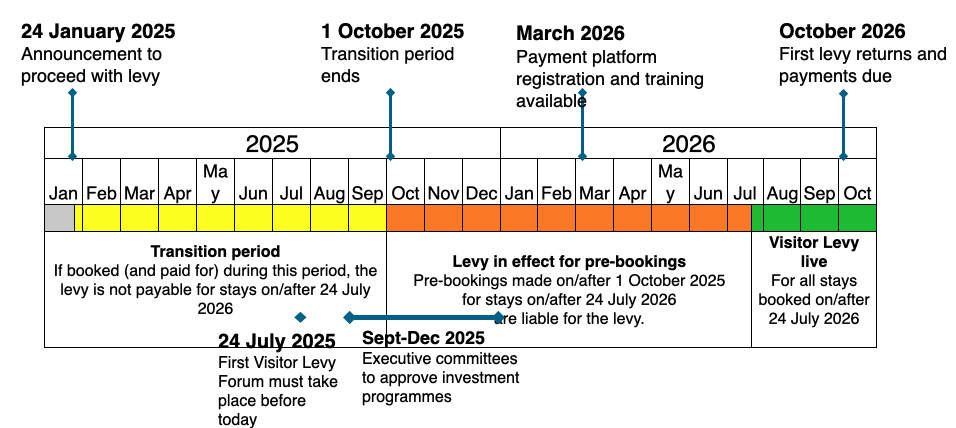

Scotland’s Rollout

Edinburgh’s 5% levy takes effect from 24 July 2026, but applies to any bookings made on or after 1 October 2025. This means you need systems in place by October 2025. The scheme is projected to generate £45-50 million annually, according to the City of Edinburgh Council, signalling serious enforcement expectations.

Glasgow will start its 5% visitor levy on January 25, 2027. Meanwhile, Aberdeen plans to implement a higher 7% rate by April 2027, as reported by Travel And Tour World. Highland, Argyll and Bute, Stirling, and West Dunbartonshire are also exploring their own plans (Insider,2025).

Beyond Scotland

Wales passed legislation in July 2025 for visitor charges from April 2027 gov.wales—£1.30 per night for most accommodation, 75p for hostels and campsites.

England’s Greater Manchester Mayor is pushing for mandatory tourist levies, following Manchester’s existing voluntary £1 charge across 73 hotels.

Understanding the Rules

Edinburgh’s levy is charged before VAT, excludes extras such as parking and meals, and applies only to the first five nights of a stay.

For example, a tourist books a 7-night stay at £80 per night. The breakdown will be as follows:

- Nights 1-5: £80 + 5% levy (£4) + VAT = £100.80 per night

- Nights 6-7: £80 + VAT (no levy) = £96.00 per night

- Total stay cost: £696.00

- Total levy collected: £20.00

Your system must automatically identify which nights require the levy, calculate correctly, separate it from VAT on invoices, and track collections for quarterly reporting.

The administrative reality

Universities have just six months between the booking cutoff and implementation to prepare systems, train staff, and communicate changes to guests.

Without automation, your team will need to:

- Check booking dates against the levy applicability rules

- Calculate the levy for nights 1-5 only, varying by room rate

- Adjust invoices to show the levy separately from VAT

- Track collections across multiple booking channels

- Reconcile payments for quarterly submissions

- Maintain audit trails for compliance verification

- Handle guest queries about unexpected charges

- Manage refunds when stays are cancelled or modified

Multiply this by hundreds of bookings, and the administrative burden becomes unsustainable.

The Compliance Requirements

You’ll need to:

- Evidence qualifying you for the 2% administrative cost reimbursement

- Complete records of all tourist bookings

- Accurate levy calculations by night and rate

- Clear separation of levy from VAT

- Documentation proving exempt bookings

The solution: automated compliance without the Headaches

Universities successfully managing tourist accommodation use integrated platforms like KxResidential that automatically handle levy compliance. These systems identify booking and stay dates, apply the correct levy percentage to nights 1-5, preserve your published rates while adjusting net pricing behind the scenes, and separate levy from VAT on every invoice.

KxResidential allows you to generate reports, provides complete audit trails, and integrates with your booking website, channel managers, and financial systems. This eliminates duplicate data entry, ensures compliance across all booking sources and accurate financial reconciliation.

The transformation is dramatic. Without a tool like KxResidential, institutions could spend 15 hours per week manually managing levy calculations, addressing guest queries about unexpected charges, mitigating risk calculation errors and penalties, and diverting staff from guest services to compliance tasks.

KxResidential scales effortlessly as new councils implement levies and taxes, such as Edinburgh’s tourist tax levy and Manchester’s new VAT rules.

Ready to Explore Modern Residential Management?

Discover how purpose-built venue management software can transform your institution’s commercial operations. Join the 80% of leading UK universities that trust Kinetic to manage their facilities, events, and commercial revenue.